Understanding Interest Only Mortgages

When it comes to securing a mortgage, the choices can often seem overwhelming. Among the myriad options available, interest-only mortgages stand out as a distinct alternative to the more commonly known capital repayment mortgages. Understanding how interest-only mortgages work and whether they are the right fit for you is crucial before diving into homeownership. Let’s unravel the intricacies of interest-only mortgages to help you make informed decisions.

How they work?

Unlike capital repayment mortgages, where you pay back both the borrowed amount and the interest monthly, interest-only mortgages operate differently. With an interest-only mortgage, your monthly payments cover only the interest accrued on the loan, leaving the principal amount untouched. This means that at the end of the mortgage term, typically ranging from 20 to 30 years, you still owe the initial borrowed amount in full.

While the initial monthly payments on an interest-only mortgage may be lower compared to a capital repayment mortgage for the same amount, the long-term financial implications are significant. Since you're not chipping away at the principal amount, the overall cost over the term of the mortgage can be substantially higher due to accruing interest.

Eligibility

Securing an interest-only mortgage isn't a walk in the park. Lenders typically impose stricter criteria for applicants due to the higher risk associated with these loans. Here are some factors to consider:

Limited Choice of Lenders: Compared to capital repayment mortgages, fewer lenders offer interest-only options, reducing the variety of deals available to borrowers.

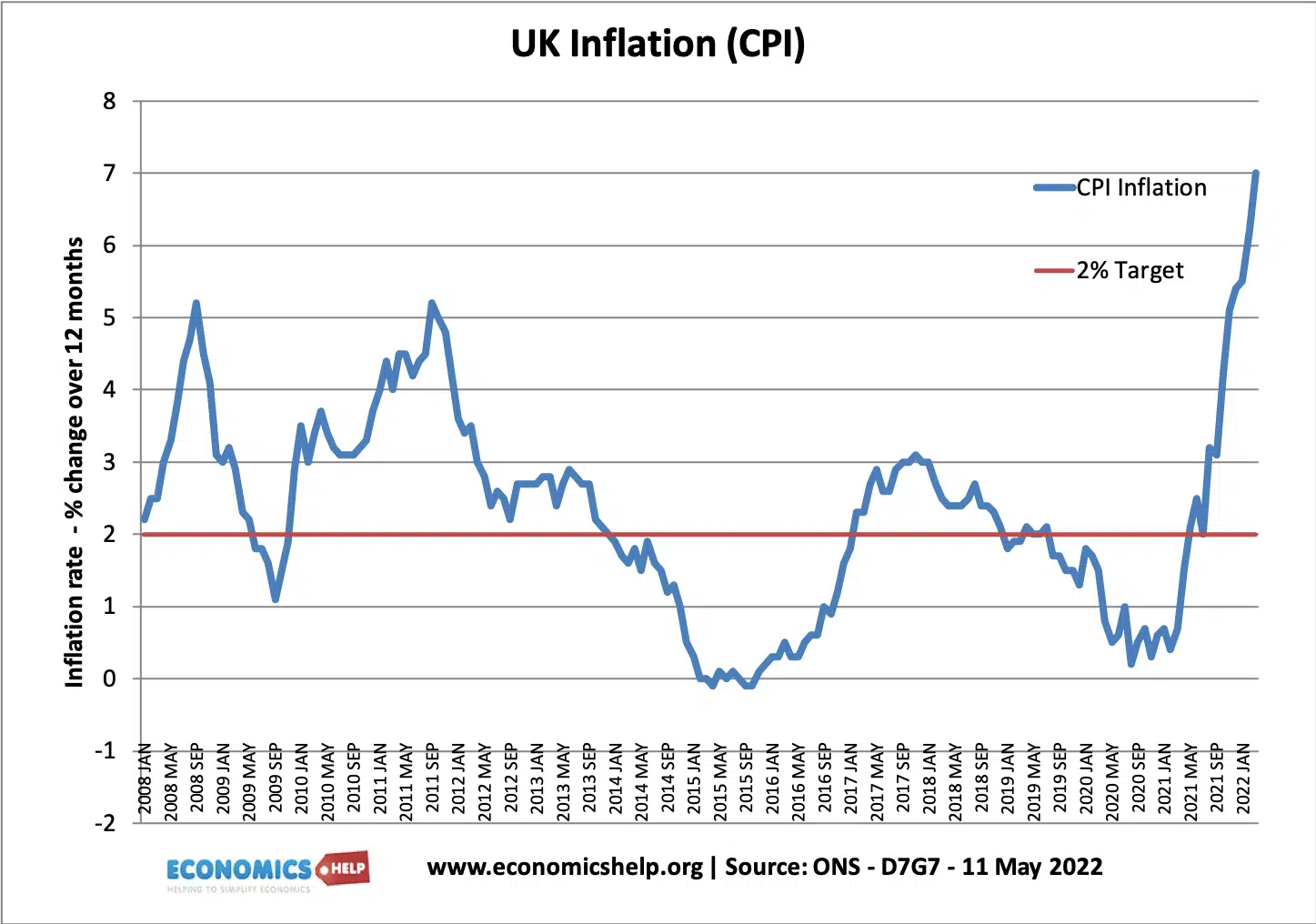

Higher Interest Rates: Interest rates on interest-only mortgages can be higher than those on capital repayment mortgages, increasing the overall borrowing cost.

Income Requirements: Lenders may require higher minimum incomes for applicants to qualify for interest-only mortgages, often favouring higher earners.

Repayment Strategy: Borrowers must demonstrate a solid plan for repaying the principal amount at the end of the mortgage term, known as a 'repayment vehicle.'

Repayment Vehicle

Having a repayment vehicle in place is crucial for securing an interest-only mortgage. These vehicles can vary and may include savings, investments, other assets, or pension pots. Lenders assess the viability of these repayment strategies to ensure borrowers can honour their financial commitments.

Cost Comparison

While interest-only mortgages offer lower initial monthly payments, they come with a hefty long-term price tag. The lack of principal repayment means borrowers end up paying more in interest over the mortgage term compared to capital repayment mortgages. This disparity in cost can amount to tens of thousands of pounds or even more, particularly over extended mortgage terms.

Making Informed Decisions

Ultimately, choosing between an interest-only and capital repayment mortgage requires careful consideration of your financial circumstances and long-term goals. While interest-only mortgages offer short-term financial relief, they come with greater financial risk and potentially higher costs over time.

Before committing to any mortgage, it's essential to weigh the pros and cons, assess affordability, and explore repayment options thoroughly. Consulting with a financial advisor can provide valuable insights and help you navigate the complexities of mortgage financing.

While interest-only mortgages may seem appealing at first glance, their long-term implications warrant careful scrutiny. By understanding how these mortgages work and evaluating your financial situation, you can make informed decisions that align with your homeownership aspirations and financial well-being.