UK Inflation Holds Steady at 6.7%

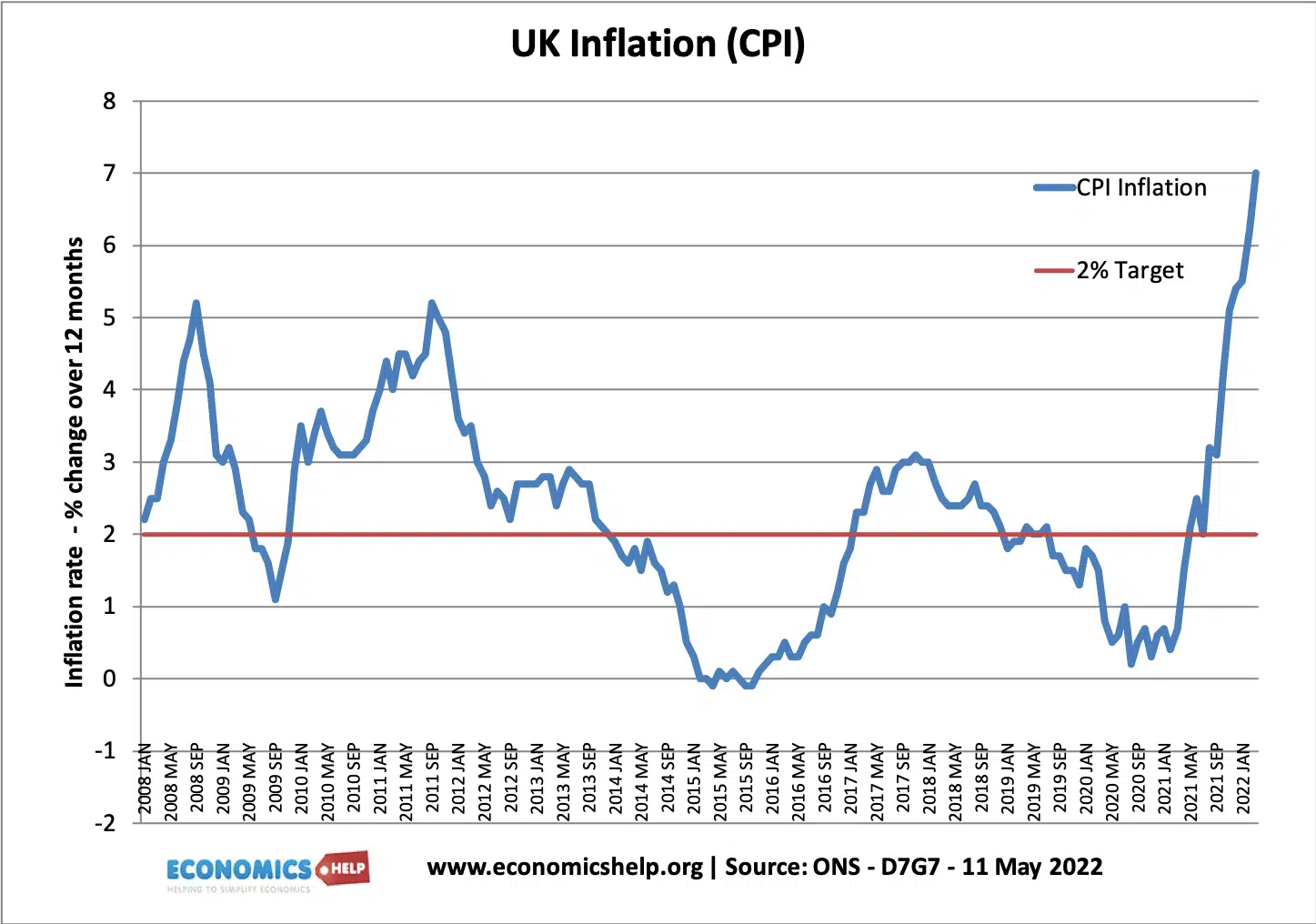

Inflation is often a key indicator of an economy's health, and it can significantly impact the lives of everyday people. In the case of the United Kingdom, the latest figures have left economists and policymakers with much to consider. UK inflation unexpectedly held steady in September at 6.7%, a rate that has raised questions about the Bank of England's next move on interest rates in November.

The Office for National Statistics revealed that the annual inflation rate, as measured by the consumer prices index, remained unchanged from August's reading, which came as a surprise to many. Economists had anticipated a modest fall to 6.6%, but this was not the case. The unexpected stability in inflation has fuelled discussions about the future of the UK's monetary policy.

Falling Food Prices

In September, there was a glimmer of hope for households as food and non-alcoholic drink prices fell by 0.2% on the month. This was the first monthly decline since September 2021. Supermarkets engaged in fierce competition, driving down prices for items like milk, cheese, eggs, mineral water, soft drinks, and juices. However, it's essential to note that despite this monthly drop, prices remain significantly higher than a year ago, with the cost of an average food shop still up by more than 12% on an annual basis.

Fuel Cost Surge

The pressure on households persists, primarily due to the surge in petrol and diesel prices, which contributed to almost all of the upward pressure on the inflation rate. This increase is a result of a sharp rise in global oil costs over recent months. The chancellor, Jeremy Hunt, commented on the situation, highlighting the need to stick to their plan to alleviate pressure on families and businesses.

Bank of England Dilemma

The latest figures come amid expectations for a finely balanced decision on interest rates from the Bank of England. After pausing its most aggressive cycle of increases in decades last month, financial markets expect the central bank to leave borrowing costs on hold at its next policy meeting in November. Some economists believe that inflation is still on track to fall below 5.1% by December, meeting Rishi Sunak's pledge to halve the rate this year.

Geopolitical Factors

Geopolitical events can have a significant impact on global oil prices. Concerns over the fallout from the Israel-Hamas conflict have pushed up the price of oil in recent days, raising the prospect of prolonged high prices for consumers at the pump. These external factors further complicate the economic landscape.

Conclusion

The steady inflation rate of 6.7% in September may have come as a surprise, but it reflects the complex and evolving economic landscape facing the United Kingdom. Policymakers and economists must carefully navigate these waters to strike a balance between supporting households and maintaining economic stability. With external factors like geopolitical events and rising global oil prices in the mix, the path forward remains uncertain. As the Bank of England makes its decision on interest rates in November, it will be a critical moment in determining how the UK addresses its cost of living crisis.