Inflation Falls to 4.6%

In a surprising turn of events, the latest data from the Office for National Statistics (ONS) reveals a significant decline in the inflation rate, dropping to 4.6%. This welcome development can be attributed to a substantial easing in energy costs, as reported last month. The key driver behind this decline was the implementation of a lower energy price cap on households at the beginning of October. This marks a positive shift in the ongoing battle against the cost of living crisis that has gripped the nation.

The Impact of Energy Prices

A year ago, the fallout from Russia's invasion of Ukraine sent pre-winter energy bills skyrocketing, exacerbating the cost of living crisis. This year, the situation is notably different, with the lower energy price cap acting as a mitigating factor. As a result, housing and household services, as well as food and non-alcoholic beverages, experienced significant downward pressure on inflation rates, contributing to the overall decline.

Household Spending Power

Despite the inflation rate being at 4.6%, below economists' expectations of 4.8%, the figure is still relatively high. However, it is a positive development for household spending power. Earnings growth has outpaced inflation since the end of the summer, with the ONS reporting a wage growth rate of 7.7%. This is a significant factor in alleviating the financial burden on households, providing some relief to consumers.

Government Response and Future Outlook

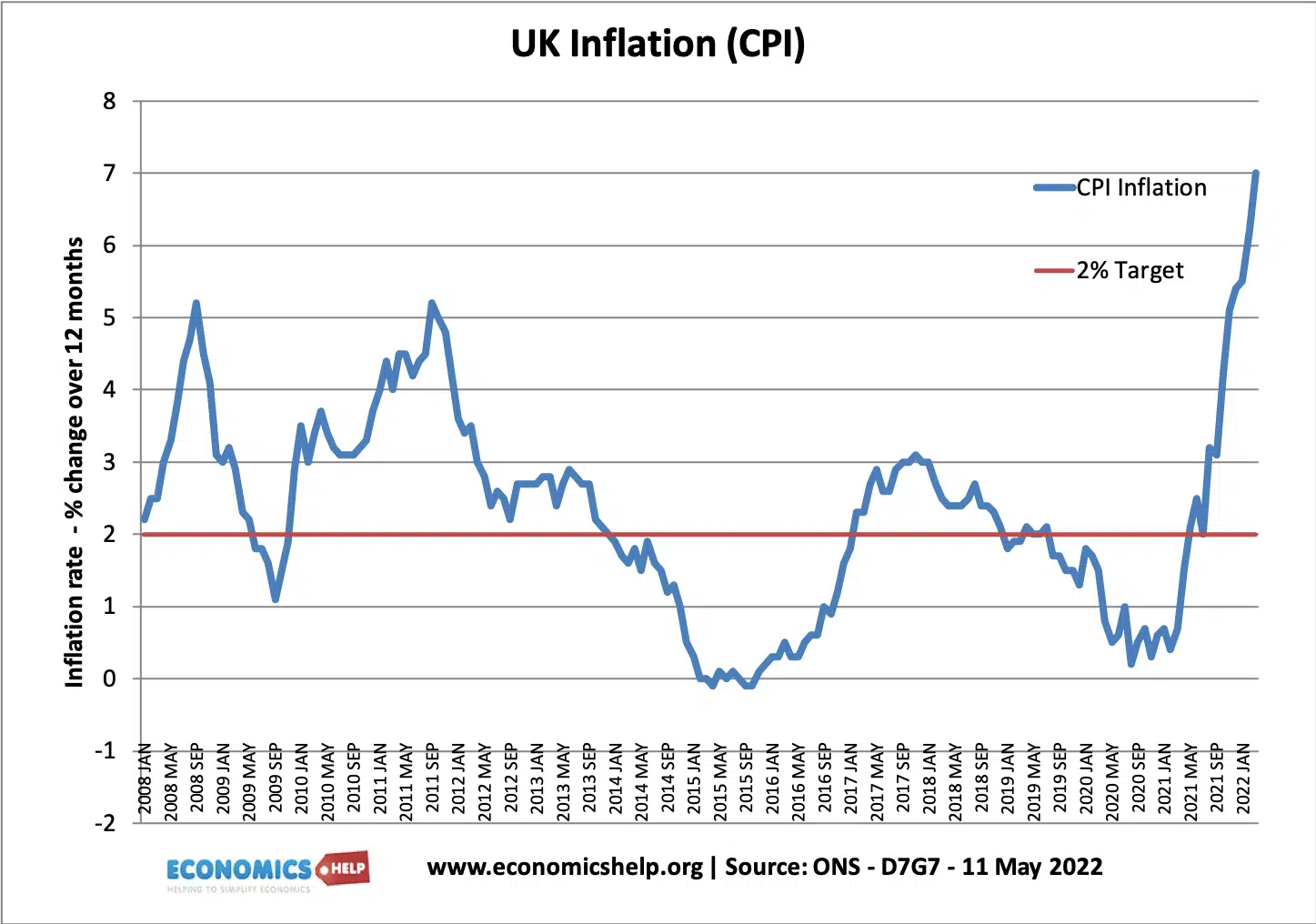

The decline in inflation aligns with Prime Minister's Downing Street pledge to halve the inflation rate this year. Rishi Sunak emphasized the importance of reducing inflation, likening it to a tax that affects various aspects of daily life, from the cost of groceries to mortgage payments and pension funds. However, Sunak also stressed the need for continued efforts to bring inflation down to the Bank of England's target rate of 2%.

Bank of England's Stance

The Bank of England, which paused interest rate hikes in September to address inflation, finds some satisfaction in the ONS data. Core inflation, which excludes volatile elements like food and energy costs, eased back to 5.7% from 6.1%. Policymakers are now keeping a close eye on wage increases, hoping to see a slowdown to prevent a potential spike in demand that could fuel further inflation.

While the decline in the inflation rate to 4.6% is a positive development, challenges persist, and the government, along with the Bank of England, must remain vigilant. The focus now turns to sustaining the momentum, ensuring that wage increases align with inflation figures. As the nation cautiously navigates economic uncertainties, the recent reprieve in inflation provides plenty of hope for household budgets and economic stability.