Government Considers 40-Year Mortgages to Help First-Time Homebuyers

The government is thinking about making changes to lending laws to support first-time buyers. One potential change is to encourage banks to offer 40-year mortgages. These long-term fixed-rate mortgages, already popular in countries like the Netherlands and Denmark, would allow borrowers to pay a single interest rate for the entire duration of the loan. This means they wouldn't have to worry about interest rate increases that can put pressure on homeowners.

City minister Andrew Griffith recently met with MPs, Bank of England officials, and lenders who offer 40-year fixed mortgages. He expressed interest in this product as a way to help more first-time buyers get into the property market. The main advantage of these mortgages is that they provide stability, as the interest rate remains the same throughout the whole 40 years. This stability means that borrowers don't have to worry about their monthly payments going up unexpectedly.

While the discussions about these long-term mortgages are still in the early stages, some lenders are concerned that not many people would be interested in them while interest rates are currently high. Many homeowners with typical two-year or five-year fixed-rate mortgages are already experiencing significant increases in their monthly repayment costs due to recent interest rate hikes by the Bank of England.

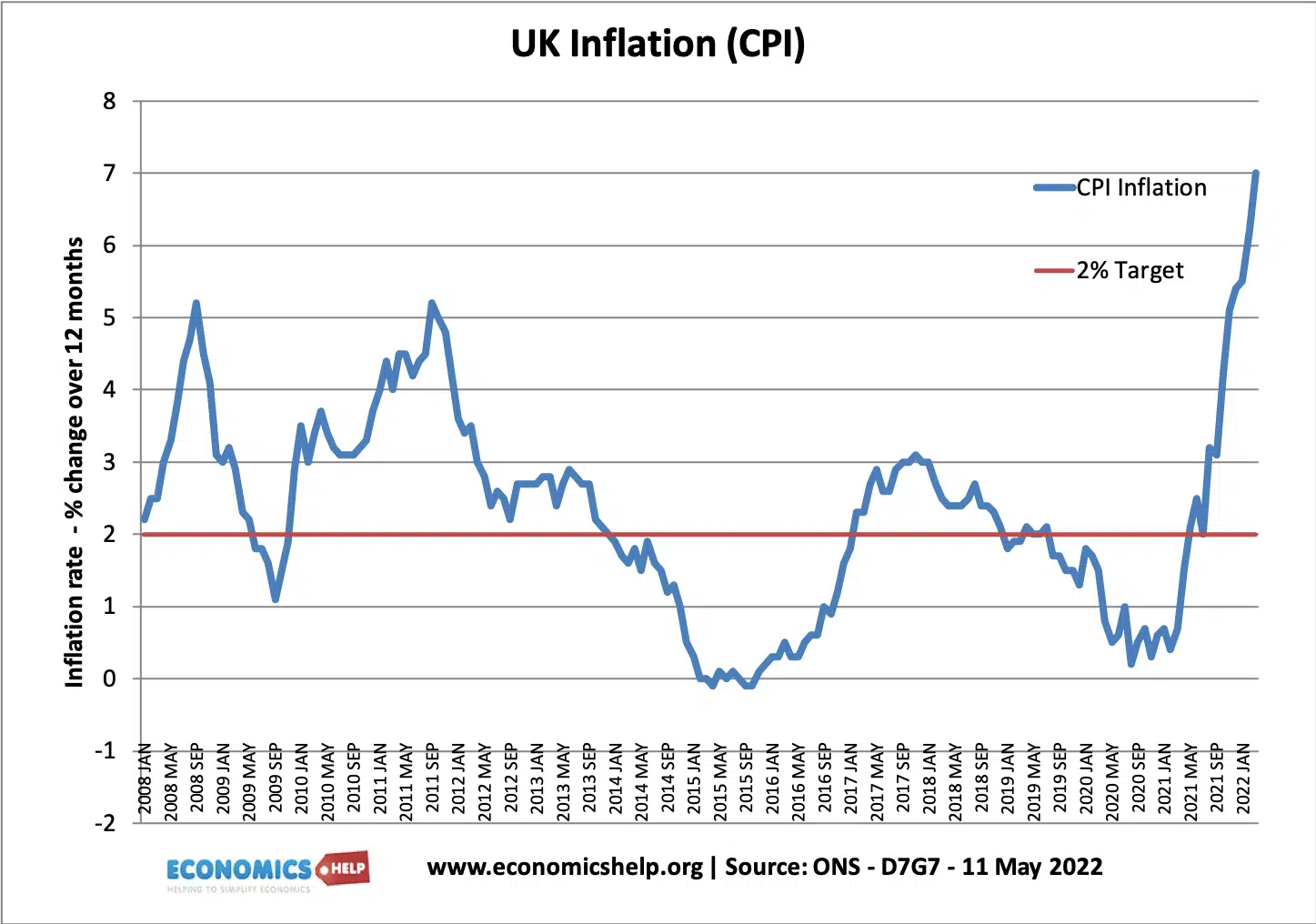

Last month, the central bank raised the base interest rate by 0.5 percentage points to 5 per cent, leading to a spike in mortgage rates. Another increase of 0.25 percentage points is expected soon. As a result, the average two-year fixed mortgage rate has reached 6.86 per cent, and five-year deals stand at 6.36 per cent. These rates are even higher than what was seen during a previous peak after a tax-cutting budget.

The Bank of England has warned homeowners that rising interest rates could cost one million borrowers an extra £500 a month by 2026. Many people are already feeling the impact, with the average homeowner facing an increase of around £220 in monthly mortgage payments when renewing their fixed-rate deals. In addition, half a million households could see payments rise by £750 a month or even more.

Considering these challenges, the government is now looking at longer-term mortgage options, like the 40-year mortgages, as a potential solution to help homebuyers. These types of mortgages have been available on the market for some time, and the Treasury encourages customers seeking more security to explore these products. However, the government also emphasises the importance of tackling inflation as the best way to assist borrowers. Additionally, they have a mortgage charter in place, agreed upon with lenders, to support households facing rising payments.